Guide to Dividend.com ››

Not sure where to start? Browse our guide to find the best dividend stocks.

Industry Dividends

Sector Dividends

Payout Changes

ETFs, Funds, Prefs, ADRs

Dividend Growers

Model Portfolios

Customized to investor preferences for risk tolerance and income vs returns mix.

Best Monthly Dividend Stocks ››

Schedule monthly income from dividend stocks with a monthly payment frequency.

Best Sector Dividend Stocks

Diversify across sectors or allocate more towards a bullish sector thesis.

Best Dividend Capture Stocks ››

Quickest stock price recoveries post dividend payment. This trading strategy invovles purchasing a stock just before the ex-dividend date in order to collect the dividend and then selling after the stock price has recovered.

Yields over 4% ››

Stocks, ETFs, Funds yielding over 4%.

Best High Dividend Stocks ››

Model portfolio targeting 7-9% dividend yield.

MLPs ››

Master Limited Partnerships.

BDCs ››

Business Development Companies.

REITs ››

Real Estate Investment Trusts

Ex-Dividend Dates ››

You must be a shareholder on or before the next ex-dividend date to receive the upcoming dividend.

Declaration Dates ››

Track recent dividend declarations and get ready for upcoming payouts.

Monthly dividends ››

Monthly payments from quarterly dividends ››

Best Monthly Dividend Stocks ››

Our picks from the +200 dividend stocks paying a monthly dividend.

Premium Dividend Research ››

Build conviction from in-depth coverage of the best dividend stocks.

Dividend Financial Education ››

Learn more about dividend stocks, including information about important dividend dates, the advantages of dividend stocks, dividend yield, and much more in our financial education center.

Dividend News ››

Stay up to date with timely dividend news.

Manage Your Money

Helpful articles on different dividend investing options and how to best save, invest, and spend your hard-earned money.

Tools ››

Discover dividend stocks matching your investment objectives with our advanced screening tools.

How to Retire ››

Learn more about planning and maintaining a happy, financially secure retirement.

ESG ETFs, Funds ››

ETFs and funds that prioritize investments based on environmental, social and governance responsibility.

Corporate Bond ESG ››

Generate fixed income from corporates that prioritize environmental, social and governance responsibility.

ESG Channel ››

ESG news, reports, video and more.

Target Date ››

Retirement Resources

Retirement Channel ››

Retirement news, reports, video and more.

Fixed Income Channel ››

Fixed income news, reports, video and more.

ESG Channel ››

ESG news, reports, video and more.

Municipal Bonds Channel ››

Municipal bonds news, reports, video and more.

News, reports, and commentary about active ETFs

Strategists Channel ››

Learn from industry thought leaders and expert market participants.

Practice Management Channel ››

Practice management news, reports, video and more.

Model Portfolios Channel ››

Model portfolio news, reports, video and more.

Name

As of 07/19/2024Price

Aum/Mkt Cap

YIELD

Exp Ratio

Watchlist

.00

.1 M

5.26%

One of the unique characteristics of AP® Psychology is the fact that the FRQ section accounts for just a third of a student’s score. While the free response may not be as greater weighted as the FRQs of other Advanced Placement classes, the two questions posted are still very important to a student’s ability to score a 3, 4, or 5. In this post, we’re going to review the best tips and tricks for answering AP® Psychology free response questions so you can feel confident about your FRQs.

Keep reading to get the scoop on everything you need to make the most of your AP® Psychology exam review.

What We Review

ToggleThere are a few vital steps when it comes to putting your best foot forward in your AP® Psychology free response section.

The concept application and the research question are the two types of questions you’ll find on the AP® Psychology free response section.

For the concept application question, you’ll be presented with a scenario in which you will need to apply concepts to the scenario to demonstrate your content mastery. The intent of this question is to assess what the College Board calls Skill Category 1: Concept Understanding.

Concept Understanding is the ability to define, explain, and apply concepts, behavior, theories, and perspectives.

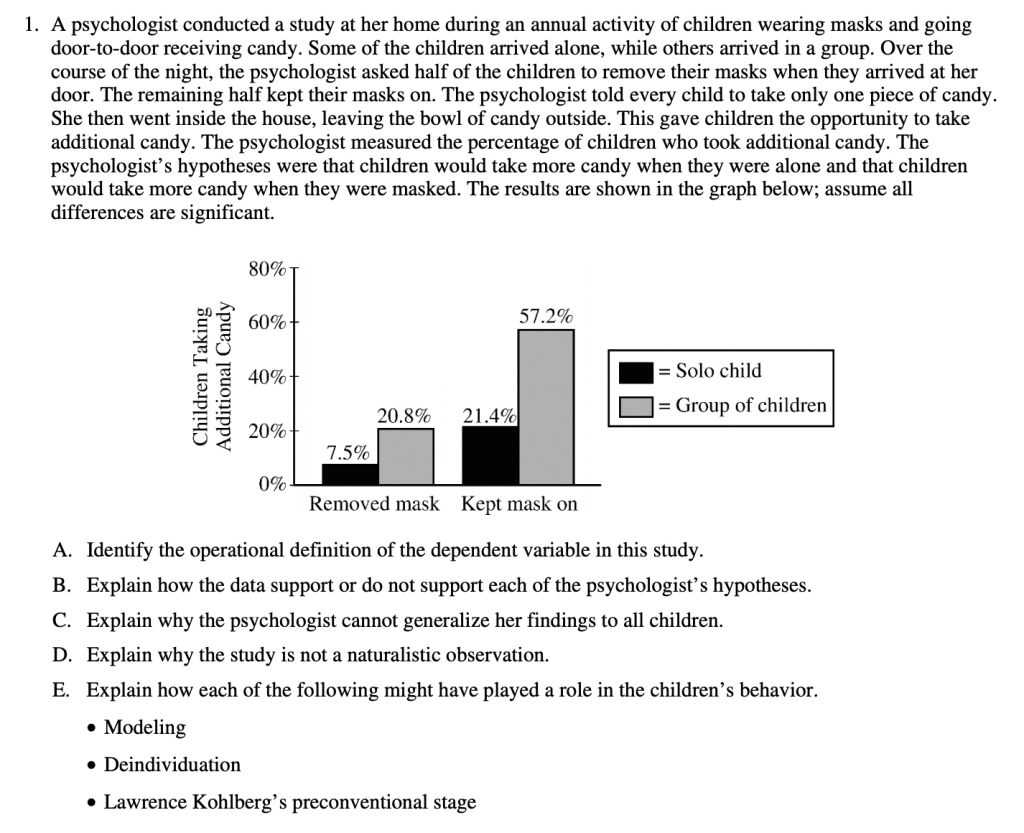

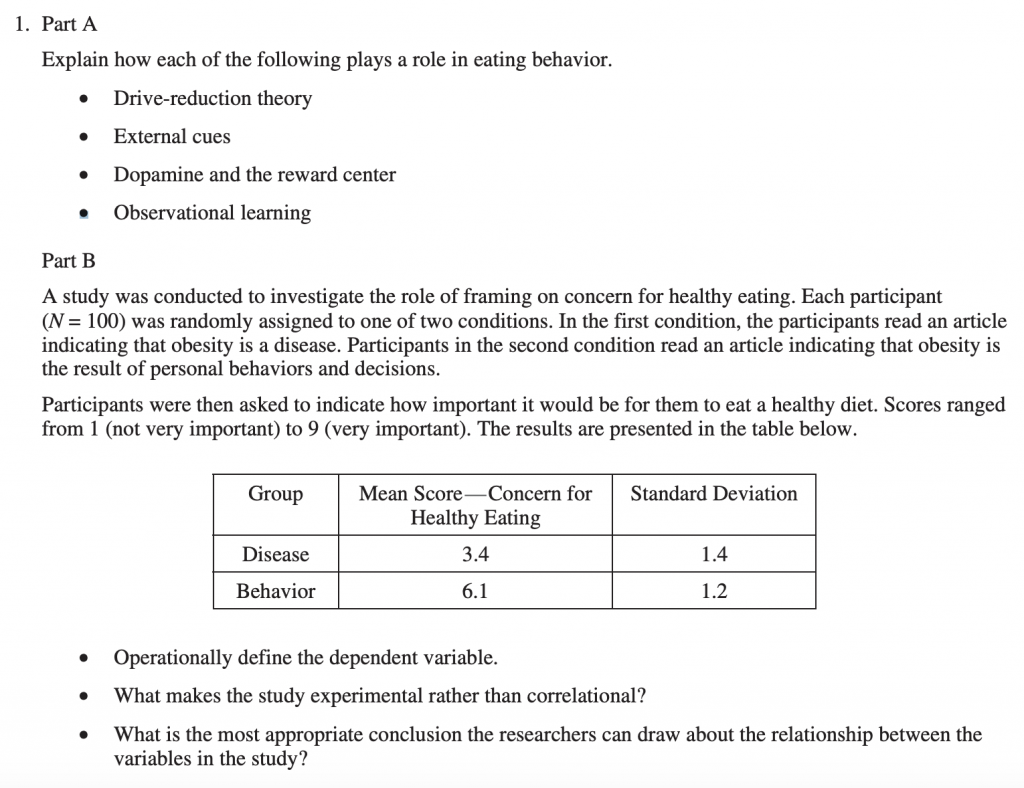

For the research question, you’ll often be given data from some form of research (i.e. experiment, survey, etc) and you’ll be assessed on your mastery of analyzing research studies.

The two skill categories assessed here are Data Analysis and Scientific Investigation.

Data Analysis is as you can imagine, the ability to read and interpret quantitative data.

Scientific Investigation is the ability to analyze psychological research studies.

A few years ago, it wasn’t always guaranteed that students would receive a research question; however, the College Board in recent years has made this more explicit that students should expect one of the two FRQs to be research questions.

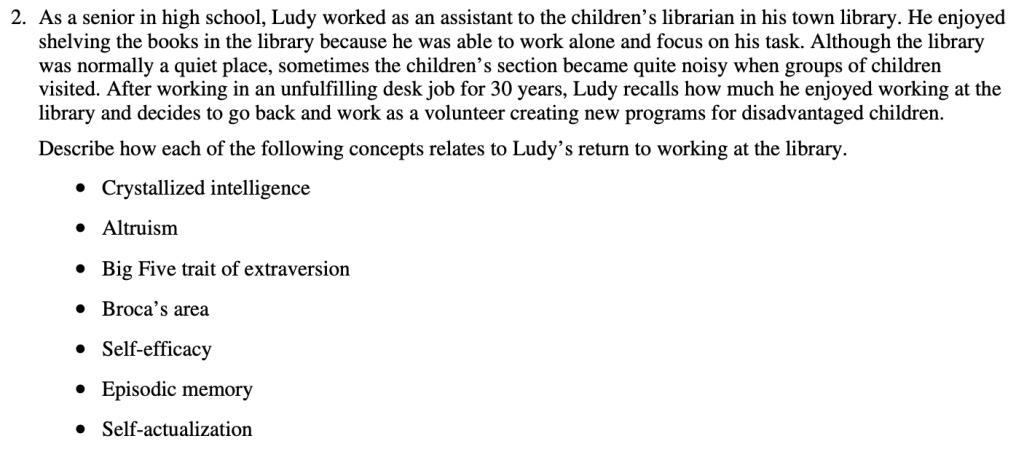

Here are two examples of concept application questions from the 2019 and 2018 AP® Psychology exams:

Notice how the key directive for students in these concept application questions is to explain and apply concepts you learned in class.

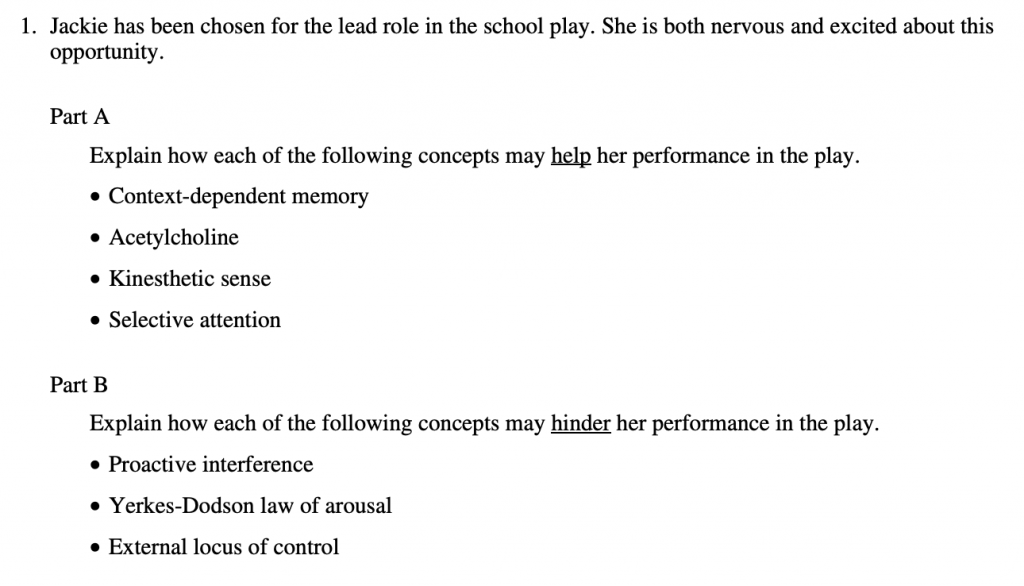

Here are two examples of research questions from 2019 and 2017:

Notice how in these research questions, one part is dedicated to assessing your ability to analyze the set up of the research study, while the other part is more similar to a concept application question and requires explanation of how certain concepts relate to the scenario.

Here is a link for AP® Psychology past released exams

These past exams include scoring guidelines PDFs which outline how points were distributed for each respective question.

The nice thing about AP® Psychology is that it hasn’t changed all that much in the last decade. This means referencing past released exams can be a way to gain more insight than you might be able to get from other places.

You can learn a lot from these scoring guidelines. For example, if you read through the 2017-2019 guidelines, you’ll notice the College Board emphasizes a few general rules of thumb regarding the concept application question:

When it comes to the research question:

Work your way through the last three year’s worth of scoring guidelines and read about the mistakes of past students. This will help familiarize you understand what to be mindful of when you start answering your own FRQs.

The bulk of the time, you will be asked to identify, describe, or explain.

To properly identify, you must provide 1-2 sentences where you directly answer the question. You will need to name the particular concept and connect it to the question prompt.

To describe, you’ll need to characterize something. This will typically take 2-3 sentences since after you characterize it, you’ll want to apply it back to the prompt. Similar directives more occasionally used could be expressed as show or illustrate.

When asked to explain, these responses often will be three sentences. One sentence to directly respond to the question, followed by 2-3 supporting and specific facts that support your answer. You’ll need to go into depth about how the particular concept or theory connects back to the prompt. Teachers often refer to these questions as ones where you want to “show the why”. Similar directives could be expressed as discuss or relate.

Aside from the directives, build the habit of also marking key vocabulary words or influential people brought up.

Taking just a couple minutes to think about your response to each part of the AP® Psychology free response questions can make a huge difference in the thoroughness of your answers.

Consider what studies from your class you can bring in; citing past studies you’ve been exposed to is a stronger response than giving a personal life example when responding to an FRQ. Think about how clear it is as to why you’re bringing up an example or study.

Finally, consider what your topic sentence will be in each explanation of yours. Writing one can help bring clarity to your thoughts as you mold your response to the question.

Remember, the College Board uses the free response of the AP® Psychology exam to assess your ability to apply concepts, read and interpret data, and analyze psychological research studies.

This means this section just recalling definitions is not enough to earn you points. You must be able to apply what you know to the situations described to you.

There is no better way to build your AP® Psychology free response test-taking confidence than through practicing.

You need to practice in order to gain exposure to enough past AP® Psych FRQs to better understand what sorts of questions will be asked of you.

For example, when it comes to the research question, you’ll be tested to demonstrate you know what is a hypothesis, independent variable, dependent variable, random sample, potential biases, and more.

The College Board provides a plethora of past released exams to help you navigate the preparation process, so use them!

We recommend teaming up with a friend or two to work on the same year together. Then, use the scoring guidelines to review the sample responses, and then to grade each other’s work. This will help you understand how a peer may have responded to the same question you answered, as well as what would and would not score you points.

Now that we’ve gone over five steps to writing effective AP® Psychology free response questions, we can dig into test taking tips and strategies to help with approaching the concept application and research question.

We recommend you read through a few of these every time you start and end your AP® Psychology FRQ practice. Then, in the days leading up to your exam, read the entire list so they stay fresh in your mind.

We’ve gone over a lot in this AP® Psychology study guide. At this point, you should have everything you need to begin practicing writing your concept application and research question responses.

As we wrap things up, here are a few takeaways to remember:

We hope you’ve taken away a lot from this AP® Psychology review guide.

If you’re looking for more free response questions or multiple choice questions, check out our website! Albert has tons of original standards-aligned practice questions for you with detailed explanations to help you learn by doing and score that 4 or 5.

If you found this post helpful, you may also like our AP® Psychology tips here or our AP® Psychology score calculator here.

We also have an AP® Psychology review guide here.

0.42%

YTD Return

3.1%

1 yr return

5.5%

3 Yr Avg Return

3.2%

5 Yr Avg Return

2.2%

Net Assets

.1 M

Holdings in Top 10

100.0%

Expense Ratio 0.42%

Front Load N/A

Deferred Load N/A

Turnover N/A

Redemption Fee N/A

Standard (Taxable)

0,000

IRA

N/A

Fund Type

Money Market Fund

Name

As of 07/19/2024Price

Aum/Mkt Cap

YIELD

Exp Ratio

Watchlist

PVOXX | Fund

.00

.1 M

5.26%

.05

0.42%

| YTD | 3.1% | 0.0% | 3.6% | 13.33% |

| 1 Yr | 5.5% | 0.0% | 1322.6% | 9.02% |

| 3 Yr | 3.2% | 0.0% | 3.2% | 6.45% |

| 5 Yr | 2.2% | 0.0% | 73.4% | 5.98% |

| 10 Yr | 1.8% | 0.0% | 1.8% | 1.27% |

Annualized

| 2024 | 0.0% | 0.0% | 0.1% | 34.04% |

| 2023 | 0.0% | 0.0% | 0.0% | 42.86% |

| 2022 | 0.0% | 0.0% | 0.0% | 42.31% |

| 2021 | 0.0% | 0.0% | 0.0% | 44.63% |

| 2020 | 0.0% | 0.0% | 0.0% | 43.97% |

| YTD | 3.1% | 0.0% | 3.6% | 13.33% |

| 1 Yr | 5.5% | 0.0% | 1322.6% | 9.02% |

| 3 Yr | 3.2% | 0.0% | 3.2% | 6.45% |

| 5 Yr | 2.2% | 0.0% | 73.4% | 5.98% |

| 10 Yr | 1.8% | 0.0% | 1.8% | 1.27% |

Annualized

| 2024 | 5.1% | 0.0% | 5.8% | 48.94% |

| 2023 | 1.3% | 0.0% | 1.8% | 60.00% |

| 2022 | 0.1% | 0.0% | 0.1% | 6.92% |

| 2021 | 0.7% | 0.0% | 0.8% | 9.09% |

| 2020 | 4.4% | 0.0% | 4868.4% | 2.59% |

| 72.1 M | 16.1 M | 86.2 B | 80.00% |

| 3 | 1 | 345 | 95.17% |

| 8.79 B | 22.7 M | 21.7 B | 8.28% |

| 100.00% | 14.2% | 100.0% | 2.76% |

| 100.00% | 35.74% | 100.00% | 8.28% |

| 0.00% | 0.00% | 1.03% | 44.14% |

| 0.00% | 0.00% | 1.01% | 51.03% |

| 0.00% | 0.00% | 0.04% | 44.14% |

| 0.00% | 0.00% | 13.25% | 54.48% |

| 0.00% | 0.00% | 64.26% | 92.41% |

| 0.42% | 0.11% | 4.99% | 46.21% |

| 0.15% | 0.05% | 0.57% | 37.24% |

| N/A | 0.00% | 1.00% | N/A |

| 0.10% | 0.03% | 0.55% | 49.40% |

| N/A | N/A | N/A | N/A |

| N/A | 1.00% | 5.00% | N/A |

| N/A | N/A | N/A | N/A |

Turnover provides investors a proxy for the trading fees incurred by mutual fund managers who frequently adjust position allocations. Higher turnover means higher trading fees.

PVOXX Fees (% of AUM) Category Return Low Category Return High Rank in Category (%) Turnover| N/A | 0.00% | 212.00% | N/A |

| 5.26% | 0.00% | 5.40% | 4.83% |

| None | Monthly | Monthly | Monthly |

| 0.08% | -1.14% | 1.97% | 7.25% |

| Annually | Annually | Annually | Annually |

| Apr 30, 2024 | .004 | OrdinaryDividend |

| Mar 31, 2024 | .005 | OrdinaryDividend |

| Feb 29, 2024 | .004 | OrdinaryDividend |

| Jan 31, 2024 | .005 | OrdinaryDividend |

| Dec 31, 2023 | .005 | OrdinaryDividend |

| Nov 30, 2023 | .004 | OrdinaryDividend |

| Oct 31, 2023 | .005 | OrdinaryDividend |

| Sep 30, 2023 | .004 | OrdinaryDividend |

| Aug 31, 2023 | .005 | OrdinaryDividend |

| Jul 31, 2023 | .004 | OrdinaryDividend |

| Jun 30, 2023 | .004 | OrdinaryDividend |

| May 31, 2023 | .004 | OrdinaryDividend |

| Apr 30, 2023 | .004 | OrdinaryDividend |

| Mar 31, 2023 | .004 | OrdinaryDividend |

| Feb 28, 2023 | .004 | OrdinaryDividend |

| Jan 31, 2023 | .004 | OrdinaryDividend |

| Dec 31, 2022 | .004 | OrdinaryDividend |

| Nov 30, 2022 | .003 | OrdinaryDividend |

| Oct 31, 2022 | .003 | OrdinaryDividend |

| Sep 30, 2022 | .002 | OrdinaryDividend |

| Aug 31, 2022 | .002 | OrdinaryDividend |

| Jul 31, 2022 | .001 | OrdinaryDividend |

| Jun 30, 2022 | .001 | OrdinaryDividend |

| May 31, 2022 | .001 | OrdinaryDividend |

| Apr 30, 2022 | .000 | OrdinaryDividend |

| Mar 31, 2022 | .000 | OrdinaryDividend |

| Feb 28, 2022 | .000 | OrdinaryDividend |

| Jan 31, 2022 | .000 | OrdinaryDividend |

| Dec 31, 2021 | .000 | OrdinaryDividend |

| Dec 10, 2021 | .000 | CapitalGainLongTerm |

| Nov 30, 2021 | .000 | OrdinaryDividend |

| Oct 31, 2021 | .000 | OrdinaryDividend |

| Sep 30, 2021 | .000 | OrdinaryDividend |

| Aug 31, 2021 | .000 | OrdinaryDividend |

| Jul 30, 2021 | .000 | OrdinaryDividend |

| Jun 30, 2021 | .000 | OrdinaryDividend |

| May 28, 2021 | .000 | OrdinaryDividend |

| Apr 30, 2021 | .000 | OrdinaryDividend |

| Mar 31, 2021 | .000 | OrdinaryDividend |

| Feb 26, 2021 | .000 | OrdinaryDividend |

| Jan 31, 2021 | .000 | OrdinaryDividend |

| Dec 31, 2020 | .000 | OrdinaryDividend |

| Dec 31, 2020 | .000 | CapitalGainShortTerm |

| Nov 30, 2020 | .000 | OrdinaryDividend |

| Nov 30, 2020 | .000 | CapitalGainShortTerm |

| Oct 30, 2020 | .000 | OrdinaryDividend |

| Sep 30, 2020 | .000 | OrdinaryDividend |

| Aug 31, 2020 | .000 | OrdinaryDividend |

| Jul 31, 2020 | .000 | OrdinaryDividend |

| Jun 30, 2020 | .000 | OrdinaryDividend |

| May 29, 2020 | .000 | OrdinaryDividend |

| Apr 30, 2020 | .001 | OrdinaryDividend |

| Mar 31, 2020 | .001 | OrdinaryDividend |

| Feb 28, 2020 | .001 | OrdinaryDividend |

| Jan 31, 2020 | .001 | OrdinaryDividend |

| Dec 31, 2019 | .001 | OrdinaryDividend |

| Dec 13, 2019 | .000 | CapitalGainLongTerm |

| Nov 29, 2019 | .001 | OrdinaryDividend |

| Oct 31, 2019 | .002 | OrdinaryDividend |

| Sep 30, 2019 | .002 | OrdinaryDividend |

| Aug 30, 2019 | .002 | OrdinaryDividend |

| Jul 31, 2019 | .002 | OrdinaryDividend |

Start Date

Tenure

Tenure Rank

Sep 30, 2006

15.68

15.7%

Team Managed

| 0.25 | 41.58 | 16.45 | 15.47 |

All stock quotes on this website should be considered as having a 24-hour delay.

* Dividend.com does not provide financial advice and does not issue recommendations or offers to buy stock or sell any security.

Certain financial information included in Dividend.com is proprietary to Mergent, Inc. ("Mergent") Copyright © 2014. Reproduction of such information in any form is prohibited. Because of the possibility of human or mechanical error by Mergent's sources, Mergent or others, Mergent does not guarantee the accuracy, adequacy, completeness, timeliness or availability or for the results obtained from the use of such information.

Dividend Investing Ideas Center

Have you ever wished for the safety of bonds, but the return potential...

Dividend Investing Ideas Center

If you are reaching retirement age, there is a good chance that you...

Dividend Investing Ideas Center

If you are reaching retirement age, there is a good chance that you...